Happy early 4th of July, I hope you and your family enjoy fireworks while celebrating our fine country.

In California, there are structural forces that limit new housing supply. Most notably, the California Environmental Quality Act (CEQA) limits housing supply, opening avenues for frivolous lawsuits that can delay/derail housing projects and overly strict zoning laws. These structural issues are a primary driver of California's cost of living, and as long as they exist, housing will be expensive.

However, builders are facing other headwinds that will exacerbate new home production, at least in the short run. Two of the most notable other headwinds are 1) construction financing and 2) insurance (especially in CA).

In a June survey of apartment developers by the National Multifamily Housing Council, 62% of developers cited challenges securing reasonable construction financing as the main reason for delaying or not taking on new development projects. Interestingly, this problem is impacting developers of all sizes. I spoke with a partner at a large national apartment developer (their typical project size is around 1,000 units). He shared my frustration at the lack of financing for projects (our typical projects are 2-6 units).

The other issue is insurance. As you might have heard, State Farm was the first insurance company to stop issuing new homeowner policies. To be clear, this is not on new homes but on new policies on homes. I was lucky to have lunch with Chris Ferarro, a long-time State Farm insurance agent, the day after State Farm halted new business in CA. Allstate and Nationwide quickly followed suit. Rumors have it that Farmers Insurance has circulated an internal memo limiting new policies in the state, which might also indicate they are next.

As I understand it, the issue is that the State Insurance Commissioner is not allowing insurance sufficient premium increases to allow insurance providers to cover their costs. By way of example, construction costs rose +15% from 21-22, but insurance premiums were only able to increase by 7% over the same period.

In certain fire-prone areas, the only insurance available is the state-backed FAIR (Fair Access to Insurance Requirements) Plan is an insurance pool providing basic property insurance to homeowners who can't secure it in the regular market, often due to high-risk factors like wildfire susceptibility. The Fair Plans are very expensive and only cover fire.

Back to insurance being a headwind for developers. I saw the ad below going around on Twitter about how crazy some new home deals are (there are some crazy new home deals, but this actually isn't one). I sent it to our team to ensure they let their clients know about this incredible opportunity, only to receive an email from Melissa Edelman on our team pointing out a very important market insight. These particular communities used to have a monthly HOA expense of approximately $300. Because of the fire zone they are in, the monthly HOA expense increased to approximately $1,000 to cover the additional insurance expense.

Assuming a 7% interest rate, a homebuyer would have to decrease their purchase price by +$105K to keep their monthly principal and interest the same.

While new home (for sale) construction remains strong, the construction financing and insurance issues outlined above will provide meaningful headwinds for construction activity. Softening is already starting to occur in the for-rent construction sector, and further supply constraints will strengthen the floor under home prices and likely lead to an acceleration of home prices when interest rates finally normalize.

Single Family Transactional Market: Inventory remains low, and buyers remain engaged. We are seeing prices hold up and even go up. Decreasing interest rates (which has not happened yet) will be the most significant catalyst to increase inventory as it can unlock would-be move-up buyers currently dealing with "mortgage lock." It is tough to justify/afford to move from a 3% mortgage to a 7% mortgage on what is likely a more expensive home. While I anticipate lower interest rates in the future, when rates decrease and by how much is hard to tell. The larger the decrease, the more significant the impact on inventory. Lower interest rates will also likely increase demand for housing as more people can qualify for homes.

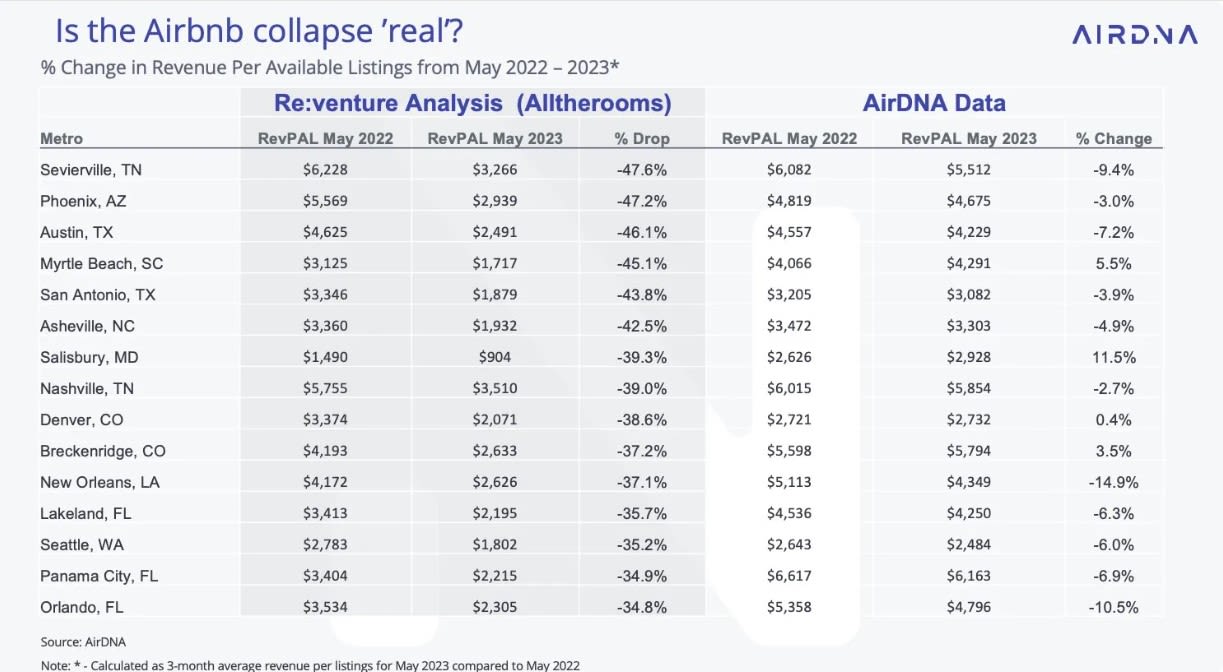

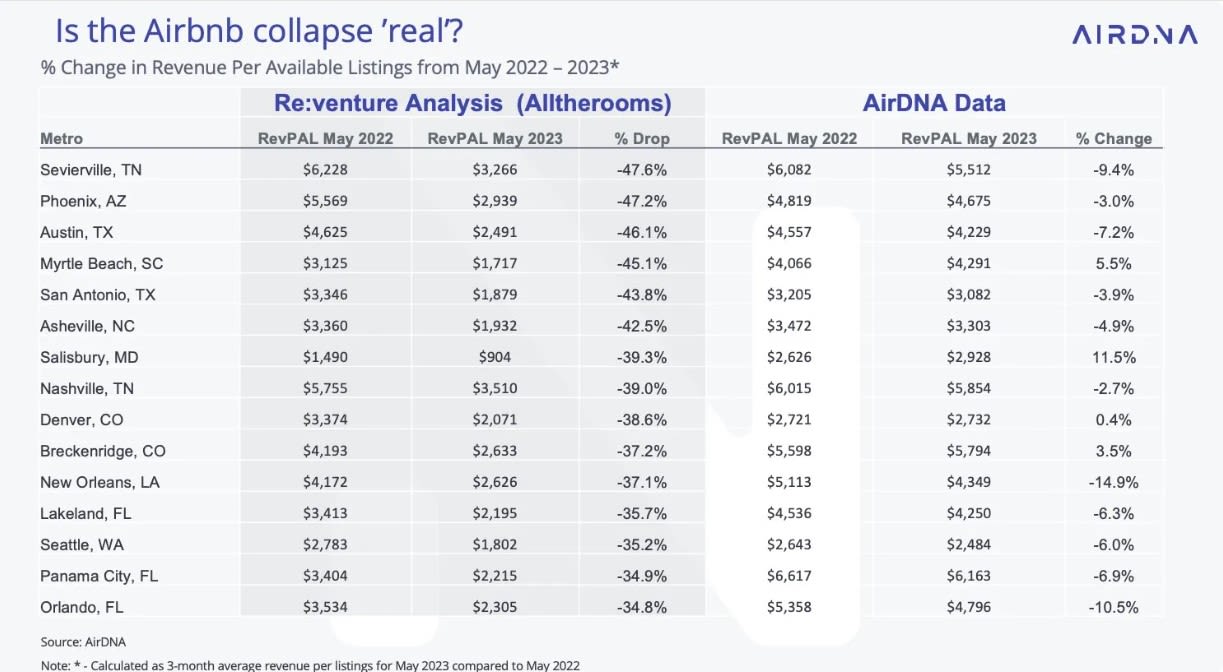

A collapse in the Airbnb Market might be another source of inventory. This additional inventory will not materialize in all markets. Still, it would be more profound in markets with limited short-term rental regulations and a higher percentage of homes that operate as short-term rentals. A fairly prominent real estate "analyst" who has gained notoriety for being a housing bear through his youtube channel tweeted some starting stats showing Airbnb revenues down as much as 50% in some markets. While I and others find these statistics suspicious, I believe Airbnb revenues are down. We are seeing challenges in our small short-term rental portfolio. Jamie Lane, the Chief Economist of AirDNA, the data provider we use, responded to Gerli's tweet with much more believable numbers. Revenues are down from 2022, but not by 40-50%, and fringe operators will likely become forced sellers. I would expect this to be evident in the markets with the largest declines (Orlando, Austin, NOLA., etc).

I want to make an important note here - we are seeing home prices hold steady and even still increase. I expect that single-family home prices, particularly in coastal California, will continue to hold up and likely increase due to lower interest rates, should we see bad economic news.

Residential Leasing Market: This month, we saw a notable uptick in leasing over the softness we have experienced over the last two or three months. In addition to increased leasing activity, we have seen an uptick in tenant turnover. An overall increase in turnover and leasing velocity could be attributable to the school year ending and the kick-off of the summer leasing season.

Mortgage Rates/Market: The Federal Reserve is expected to hike rates by 25 BPS in the upcoming July meeting, which has already been largely factored in by many investors, suggesting retail rates should remain relatively stable. Large banks like Wells Fargo are tightening guidelines, requiring higher down payments for their jumbo products. Similarly, Golden One Credit Union has withdrawn its jumbo 30-year fixed option. Due to competitive pricing and flexible guidelines, direct lending or broker options are becoming more attractive in this environment. As real estate inventory remains tight, securing a fully underwritten pre-approval can help potential buyers make their offers more attractive, enabling them to compete against cash offers and expedite the closing process.

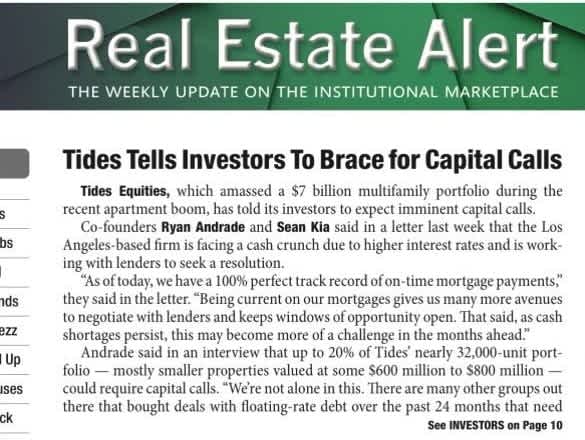

Commercial Real Estate (CRE): Somewhat as a follow-up from last month - another large multifamily investment group, Tides Equities, has found itself facing financial hardship. It's unsurprising to find Tides in peril; they acquired nearly $7B worth of assets using mostly floating-rate debt. Warren Buffett's famous quote feels too obvious, but I can't help myself here:

“Only when the tide goes out do you learn who has been swimming naked.”

There are others out there that will need to raise capital to continue to service their debt, but it is not just the investors who binged on floating-rate debt that need to be wary. It's important to note that these challenges are in multifamily, a property sector still performing well from an operations standpoint. If these problems exist in multifamily, office, hospitality, and retail investors are feeling the heat.

While many observers have been expecting Tides and other groups that binged on floating-rate debt to find themselves in trouble, more prudent investors who fixed their interest rates through interest rate swaps are also getting nervous. Most interest rate swaps allow the interest rate to be fixed for a short period (usually a few years). The longer interest rates stay elevated; the more investors will face interest rate risk.

For those of you who missed the March edition (link here) - there is a good explanation of swaps in the Capital Market Commentary Section.

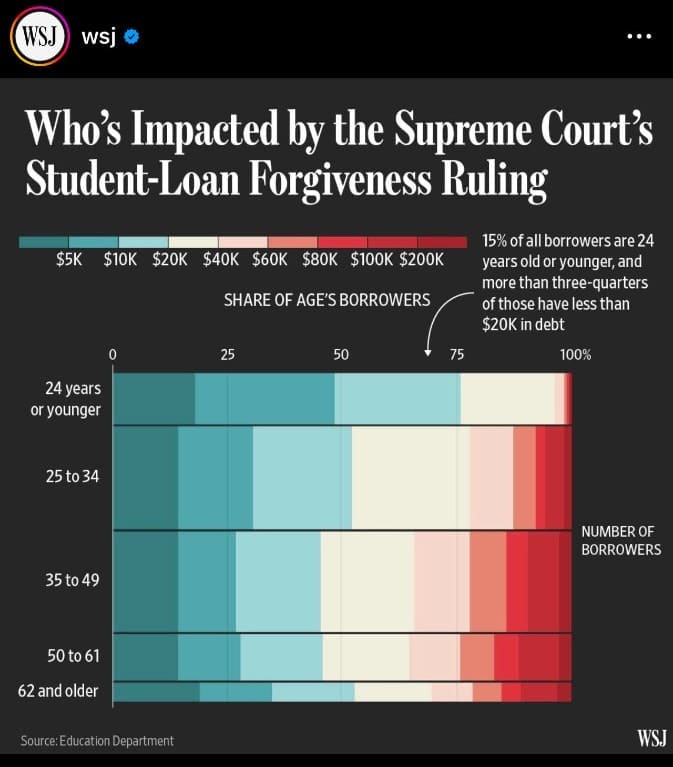

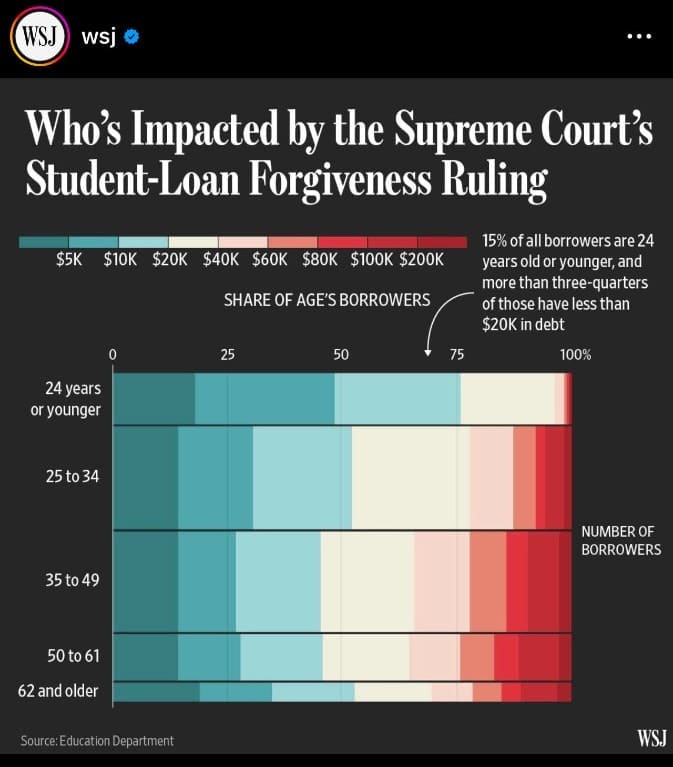

What's The Good Word: After the 6/30 Supreme Court ruling - student loan repayments are kicking back in as soon as September. As discussed last month, I am convinced this will be a massive blow to consumer spending. The table below breaks out the borrower's age and amount of outstanding student loans.

Borrowers have not made student loan payments in over three years, and many aged 24 and under were likely in college when the student loan payments were frozen and have NEVER made a student loan payment. Borrowers have had three years of spending habits based on zero student loan payments, many with the expectation of some form of student loan payment. It's worth noting the Biden administration is trying to eliminate penalties for failure to pay for the next 12 months, which is effectively another year-long deferral.

The exposure is focused on the 25-49 cohort, representing significant consumer spending.

One question I had for Grant Sedlak was - how were student loans treated over the last three years by lenders for home loans? If lenders could ignore student loans, that could mean trouble for the housing market. However, the good news is, with very few exceptions, mostly focused on loans for doctors, borrowers were qualified for mortgages assuming repayment of their student loans.

Macro Observations: No one has any idea what is going on. After the Federal Reserve voted not to increase rates this month for the first time since March 2022, there was speculation that the Fed might be done raising rates. However, strong employment numbers and persistent inflation suggest that the Fed might not be done with their rate increases. The Fed has indicated they expect to raise rates at least two more times this year.

Increasing rates will further

The increased rates will continue to put pressure on the economic ecosystem; all the while, we have a tsunami of commercial real estate loans maturing that will require a cash infusion or will become a distressed sale, and student loan repayments restarting, which will wipe out BILLIONS of dollars of consumer spending. All this is to say, I'm not very bullish on the economic outlook over the next 12 months.

But we live in strange times, and sometimes bad news is good news, and the good news is bad news (e.g., a strong job report is an inflationary indicator and leads to higher rates). Many economists, including those at the Fed, have a much more positive outlook.

Project Updates: We have several ongoing projects; here is a quick update on one of them:

Redlands Place, Costa Mesa: we acquired this property in June of last year and have been diligently working on architecture, permits, and completing small lot subdivision with the County. The lot split should be completed in the next few months, at which point we will evaluate selling the property to a builder or securing construction financing to commence construction. It's important to note that despite this project being "by right," getting a shovel in the ground will take approximately 18 months. To help offset carrying costs, we are operating the back home as a 30-day furnished rental and have leased out space for outdoor storage. This revenue will enable us to hold the property in the event economic conditions do not enable a sale or justify starting construction.